A New York startup called Everbloom says it can make cashmere-class fibre without new goats—by rebuilding fibre from pre-consumer cashmere and wool waste (mill offcuts, yarn rejects). The trick is a protein melt-spinning process adapted from synthetic fibre manufacturing, so mills can run it on existing machinery. Everbloom has been piloted with multiple heritage Italian mills (including Prada’s partners) and raised a seed round led by Hoxton Ventures, aiming for broad adoption by 2026. If it scales, brands get cashmere feel at a lower environmental cost and competitive price, and herding pressure eases.

Why cashmere needs a rethink (the problem, in one minute)

- As cashmere got cheaper and more widespread, ecological pressure rose: overgrazing and desertification in source regions (especially Mongolia) and resource-intensive processing. Mainstream experts now argue the industry can’t keep growing virgin cashmere volumes if fashion wants to hit climate goals.

The Everbloom idea, simply

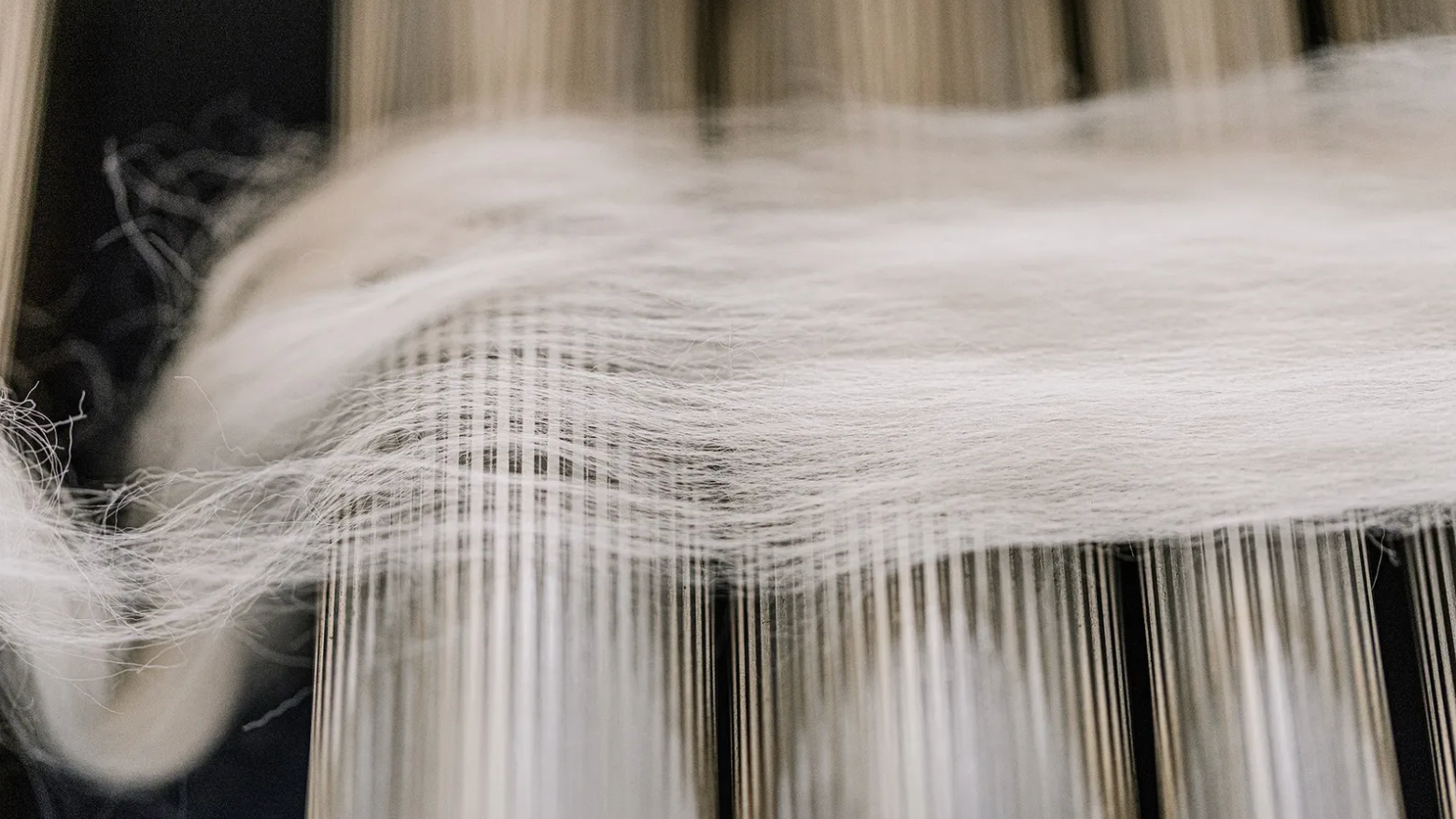

Instead of picking through post-consumer sweaters, Everbloom taps “clean” pre-consumer waste from mills (offcuts, excess yarn, production rejects) and reforms those proteins into a new, luxury-grade protein compound that behaves like cashmere or fine wool. The company says the result can run on the same spinning/knitting kit mills already own—no retooling.

Why pre-consumer waste? It’s consistent and uncontaminated (no dyes/finishes from home laundry, no unknown blends), which improves quality and traceability. (The wider industry has been tightening documentation standards for reclaimed inputs for exactly this reason.)

What’s actually new here (the tech leap)

- Protein melt-spinning. Everbloom says it “teaches” natural proteins to behave like synthetics during melt extrusion & melt spinning—processes normally used for polyester/nylon—to produce a fine, continuous filament that can be cut or used as-is. In plain English: take protein waste → purify & cross-link → melt-process into fresh, consistent fibre.

- Compatibility. Because the output mimics incumbent fibre formats, mills can plug it into existing lines (spinning, dyeing, knitting) with minimal disruption—critical for adoption.

Who’s testing it, and when can you buy it?

- Pilots: Everbloom says it has piloted with half a dozen heritage Italian cashmere mills, explicitly naming Filati Biagioli Modesto (Zegna Group), and is engaging Prada and others. Goal: ~12 mills across Italy/Europe by end-2026.

- Commercial launch: Announced 19 August 2025, alongside a seed raise (reported between $8–$10M across outlets). Variance likely reflects round components or reporting cut-offs; the lead investor is Hoxton Ventures with participation from SOSV and others.

How it stacks up vs recycled cashmere you’ve seen before

Traditional recycled cashmere (often post-consumer) can feel short-stapled and weaker, so luxury brands limit it to blends or small capsules. Everbloom’s pitch is “virgin-like feel” with scalable consistency because the feedstock is controlled and the polymer (protein) is rebuilt, not just shredded and respun. That’s why heritage mills are even entertaining trials. (Industry commentary has long flagged quality drops as a blocker for recycled cashmere.)

The sustainability case

Potential wins

- Lower land pressure: Diverts demand away from extra goat herds; reduces overgrazing risk in Mongolia/Inner Mongolia.

- Waste valorisation: Turns mill scrap into premium feedstock, which aligns with tightening waste-disposal rules in Europe.

- Price realism: Startups rarely win if they cost more. Everbloom explicitly targets at or below merino/cashmere price points to drive adoption at scale—crucial for real impact.

Open questions

- Process energy/chemistry: Melt-processing proteins is novel; full LCA data (energy, solvents, yields) isn’t public. Brands should ask for independent LCAs and wastewater disclosures. (That’s where traceability tools like Textile Exchange’s updated RMDF help standardize claims.)

- Handfeel at scale: Pilot yarns can feel great; consistency across tonnage is the true test. Expect rigorous pilling, abrasion, and handle testing at mills.

No retooling = faster onboarding.

If trials confirm “drop-in” behavior, adoption can slot into current planning cycles.

Blend strategies

Early adoptions may appear as 15–50% blends with virgin cashmere/fine wool, graduating to 100% once KPIs hold.

Sourcing narrative

Luxury houses can reserve scarce virgin cashmere for hero SKUs while broadening knit assortments with Everbloom fibre to protect margins and reduce ecological scrutiny.

Compliance & claims

Expect auditors to ask for feedstock proof (pre-consumer origin), chain-of-custody, and LCA. Use the RMDF and GRS/RCS pathways to tighten data.

If you’re in India: the opportunity

Italy is the beachhead, but Indian spinners/knitters (e.g., Ludhiana, Tiruppur) could be fast followers if the fibre truly is machine-compatible. India’s scale in fine-gauge knitting, dyeing, and finishing makes it a logical next hub once supply broadens—especially for premium winterwear exports where cashmere-like handfeel wins.