For decades, Tirupur has been the heartbeat of India’s knitwear industry, exporting cotton T-shirts and innerwear to global markets. But now, this industrial town in Tamil Nadu is preparing for a major shift—from cotton to synthetics. The plan? Raise the share of man-made fibers (MMF) from just 10% today to 30% by 2030. This change isn’t just about fabrics; it’s about India positioning itself as a China+1 sourcing alternative for global apparel buyers.

Global Demand Patterns

- Globally, MMF accounts for over 70% of textile consumption (mostly polyester, nylon, and acrylic), while cotton makes up less than 30%.

- Yet, India’s exports remain heavily cotton-skewed, limiting its competitiveness in fast-fashion, sportswear, and performance wear categories.

China’s Dominance and Buyers Diversifying

- China controls 65% of the global MMF market, but rising costs, trade tensions, and geopolitical risks are pushing brands to diversify sourcing.

- Buyers are actively looking at India, Vietnam, and Bangladesh to reduce dependency.

Domestic Push

- India has abundant polyester capacity (Reliance Industries is a global leader in PTA and polyester).

- The government’s PLI scheme for textiles, coupled with free trade agreements (FTAs) under negotiation with the UK, EU, and others, will make MMF exports more attractive.

What This Means for Tirupur

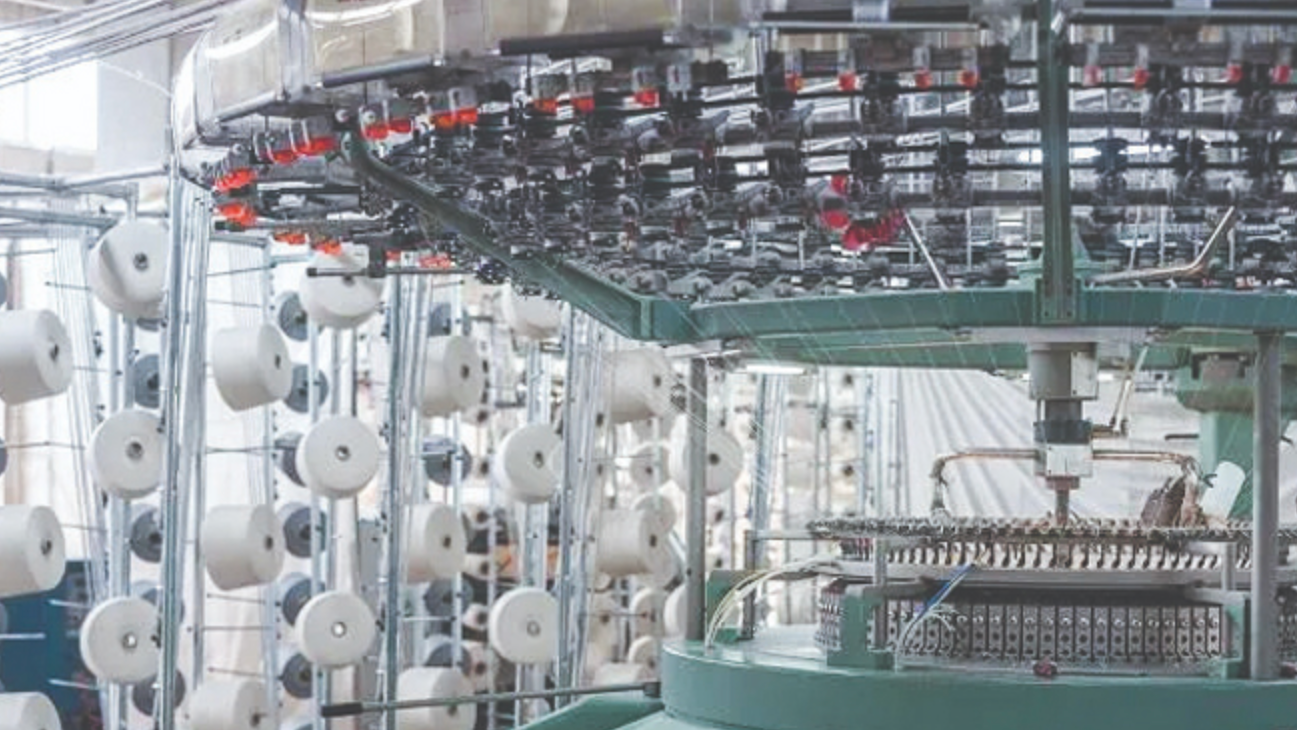

- New Infrastructure: Factories in Tirupur are investing in MMF knitting machines, dyeing units for polyester blends, and finishing technologies like moisture-wicking and anti-odor coatings.

- Product Diversification: Instead of being known just for cotton tees, Tirupur aims to become a hub for:

- Activewear & athleisure

- Swimwear & outerwear

- Blended fashion knits (cotton + poly)

- Job Creation & Training: Workers skilled in cotton need re-training to handle synthetics (e.g., heat settings, shrinkage controls, sustainability processing).

Challenges Ahead

- Sustainability Concerns: Polyester is fossil-fuel based. Unless backed by recycled polyester (rPET), this shift could clash with sustainability goals.

- Competition with Vietnam & Bangladesh: Both are ahead in MMF exports and have trade advantages with key markets.

- Technology Gaps: India needs to upgrade not just spinning/knitting but also finishing and chemical processing to meet international performance standards.

Why This Story Matters Globally

- For Brands: This shift gives international buyers an alternative to China’s MMF dominance.

- For India’s Textile Industry: Cotton will remain iconic, but MMF is where growth, margins, and future relevance lie.

- For Sustainability Conversations: India has a chance to lead in recycled synthetics if infrastructure develops alongside MMF growth.

Tirupur’s cotton legacy put India on the global knitwear map. But its synthetic surge could decide whether India becomes the next global hub for sportswear and performance textiles—or misses the wave to faster-moving competitors.

This is more than a fabric trend; it’s a strategic textile shift that could redefine India’s role in global fashion supply chains by 2030.